Risk Statement

INTRODUCTION

Lending to property companies and property developers via CP Capital is high risk and you could lose all of your money invested. This is a high-risk investment and is much riskier than both a savings account and 1st charge secured debt lending (e.g. such as is offered on CrowdProperty.com). Your funds are not covered by the Financial Services Compensation Scheme (FSCS)

Protecting investors’ money remains our priority. It is our responsibility to address each of the risks involved to mitigate their effect in the best ways possible. Investors should not participate in 2nd charge lending without full understanding of the risks and being comfortable that they can afford to lose the whole of their investing which in turn could alter their standard of living. If you are comfortable with this position we would further urge that investors diversify their investments as much as possible by lending across a range of different projects and developers.

Under the CP Capital investor terms and conditional you have agreed that CrowdProperty is acting as the agent in the underwriting and management recovery of your loan.

DUE DILIGENCE PROCESS

Underpinning our whole approach to risk mitigation of CrowdProperty and CP Capital projects is an industry-leading three-tiered system, proven by our 0% capital losses to date which aims to protects investors’ funds as much as possible (however capital is still at risk) and benefits borrowers too.

The three tiers are:

1. RIGOROUS DUE DILIGENCE

All projects offered by CP Capital undergo our rigorous due diligence criteria and are scrutinised by our extensively resourced team of property development experts who are proven to fully understand the complexities and intricacies of financing in the property development asset class

2. 2nd CHARGE SECURITY

CrowdProperty will only write CP Capital, 2nd charge loans when they sit behind the 1st charge security offered by CrowdProperty. CrowdProperty will not write a 2nd charge CP Capital loan that is junior to 3rd party lender. The reason for this is that it gives CrowdProperty complete control over the security of the project, a full understanding of the project dynamics and the ability to assess that the borrower can deliver. CrowdProperty will only write 2nd charge loans when they are completely satisfied with the 1st charge proposition, have had sign off from the external legal, RICS and IMS due diligence and all Finance Agreements have been executed.

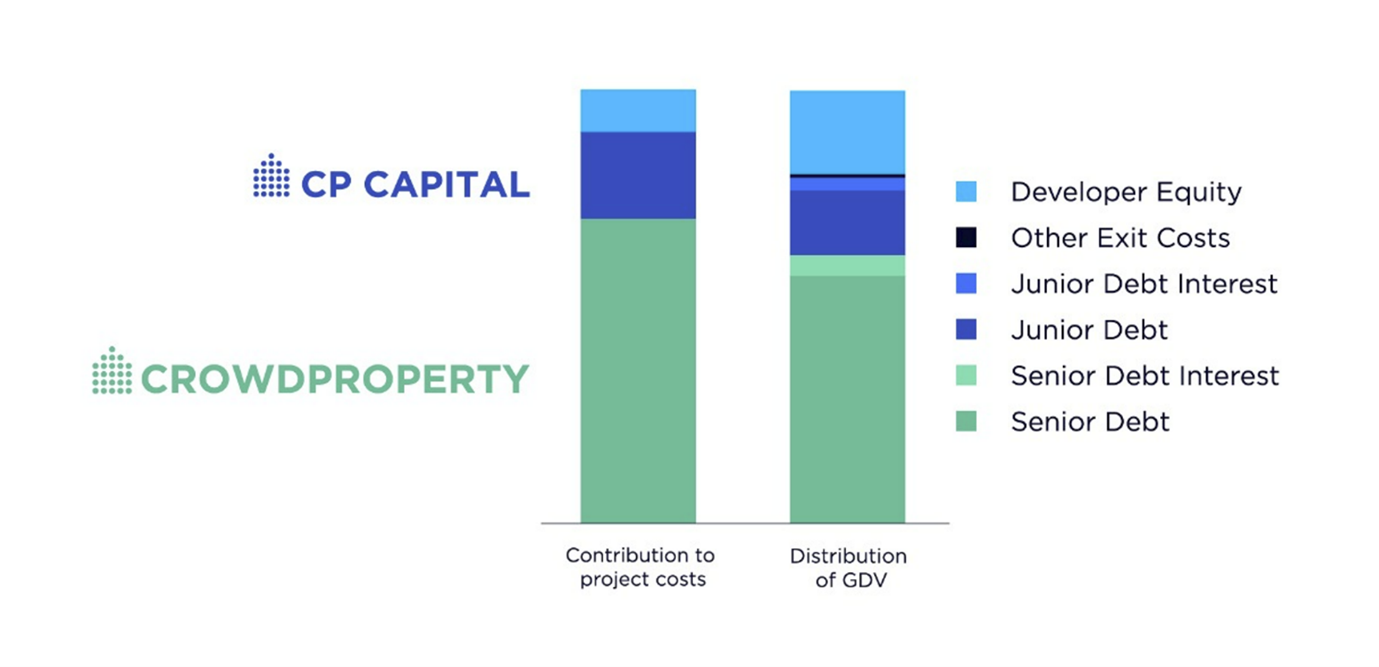

All 2nd charge loans are secured by a means of 2nd legal charge as registered with the Land Registry and secured against the property asset. However, the 2nd charge position will rank behind the 1st charge position, so any 2nd charge secured loan is paid back only after the capital and interest commitments of the 1st charge have been fully redeemed.

The lender must be clear, comfortable and fully understand that participating in a 2nd charge loan is an investment that is significantly more risky than the 1st charge secured lending CrowdProperty offers and if external market dynamics tighten or the project hits a financial problem whilst inflight the 2nd charge position will be compromised ahead of the 1st charge position.

3. UNPARALLELED EXPERTISE

Our hands-on experts oversee and ensure the success of all projects, as they have proven since 2014 managing the track record that CrowdProperty has demonstrated.

These three tiers of security work to reduce each of the risks of lending to property developments as shown below:

CONFLICTS OF INTEREST

CrowdProperty will only write a 2nd charge loan when we already have, or will take, the 1st charge position, this can create a potential for a conflict of interest. Legally the 1st charge loan will take precedence. The 1st charge loan will be recovered 1st in the order of capital and then interest. The 2nd charge loan will be paid out next – in the order of capital and interest. As CrowdProperty is responsible for the management of both the 1st and 2nd charge loan, there is a potential conflict if one of the loans were to get into difficulty. If CrowdProperty believes either loan is in danger of being compromised, two separate LPA Receivers will be instructed to recover the loan(s) - ensuring a dedicated receiver focusing on each loan individually.

As outlined in more detail below, there will be Director participation in each 2nd charge loans, which again has the potential to cause a conflict of interest. There is the potential that it would cause the focus to be directed to one of these loans, however as outlined above if CrowdProperty believes either loan is in danger of being compromised, two separate LPA Receivers will be instructed to recover the loan(s) - ensuring a dedicated receiver focusing on each loan individually.

One Non-Executive Director (NED) who will not be participating in any loans will be the arbiter should any situation arise, that may be subject to conflict. Reports are made to the board monthly on any loans that are in difficulty and/or are overdue, based on these reports the NED would be responsible for deciding on the best way forward, whether receivers need appointing and if so if this should be on one or both loans.

DIRECTOR PARTICIPATION

Directors of CrowdProperty have agreed to participate in every loan funded at 2nd charge level. This is to include 2 or more directors for each loan. Directors participating in all CP Capital loans shows our own confidence in the proposition.

It is intended that Main Board Directors and Executive Committee will participate in each and every 2nd charge loan to an aggregate total contribution of between 5% and 12% of the total 2nd charge loan facility. Principal Shareholders will also be permitted to participate provided they hold more than 4% of the company's shareholdings.

One Non-Executive Director will not participate and will be the arbiter should any situation arise that may be subject to conflict.

Connected parties, namely immediate family including spouse and children over the age of 18 will also be permitted to be part of this arrangement. Other members of the family will NOT be permitted to be involved unless they have been lenders in the 1st charge position for more than 3 years and only if they pass the necessary Appropriateness tests to ensure they qualify as a sophisticated or high net worth investor.

Senior employees of the company may also participate in 2nd charge loans, subject to the approval of a minimum of 2 Board Directors, one of which being the appointed independent Non-Executive Director and passing the necessary appropriateness test.

PLATFORM WIND DOWN PLAN

As part of our operational and regulatory requirements as well as our dedication to openness and transparency, as evidenced by our third party data verification by Brismo and membership of the P2PFA, we have elected to publish our Wind Down Plan detailing what would happen in the unlikely event of the failure of CrowdProperty as a business.

This Wind Down Plan is a living document and will be updated periodically as part of CrowdProperty’s dedication to acting in the best interest of lenders and borrowers. This document and associated financial planning have been reviewed by our Backup Service Provider, Smith and Williamson.

Download CrowdProperty Wind Down Plan

PROPERTY VALUE FLUCTUATION RISK

Property prices can go up and down as a result of a wide range of economic factors on a national, regional and local level. Different property types may be more or less susceptible to reduced or negative growth.

It is the mainstay of our business, however, that we understand the factors affecting property value fluctuations, so that we can identify properties that are the most secure investments.

For every investment opportunity, our in-house property experts assess the property’s full details. We assess the desirability of the local area in terms of inward investment, business growth and employment, good transport links and local facilities and amenities. All these changing factors affect a property’s initial and final value.

We also commission an independent ‘red book valuation’ of each specific property by a member of the Royal Institution of Chartered Surveyors (RICS) – the world’s leading professional body for standards in property and construction - to confirm the specific project values for loan security purposes. Every property is different.

Based on the existing and projected final value of a property project our experts calculate what Loan To Value (LTV) finance ratio we will agree. This calculation is a fundamental part of how we protect investors’ funds, whilst also supporting borrowers by understanding the full potential of their projects.

The LTV figure is a measure of how much of a buffer the Lender has to mitigate the risk of any adverse events, such as a property price decreases. Our 2nd charge loans will not exceed 80% LTV {including rolled up interest}, thus providing a buffer for the lender to mitigate the risk in the event of any adverse events.

2nd charge loans may be introduced at the commencement of the 1st charge loan (and therefore at the beginning of the project) or inflight when some additional value has been created but the borrower requires a top up to complete the construction works. Clearly these alternative positions have a different risk profile, and this is recognised in our pricing structure.

2nd charge loans will only be offered in one phase; either at the outset of the project or when the project is in flight.

in analysing 2nd charge loans are assessed on the basis of developer Profit on Cost, the Loan to Cost and Loan to value. CP also assess the developers’ motivation in completing the project, both on the equity injected into the project and level of anticipated profit on completion of the works

BORROWER RISKS

There are several factors that may result in a borrower defaulting on their loan repayments and so jeopardising investors’ returns. To mitigate this risk we undertake rigorous due diligence. This is to ensure that the loan agreement is affordable for the borrower, however your capital is still at risk and you may lose all of what you invest. This is especially so with 2nd charge loans given the higher risk LTV position and the interest roll up format.

Rigorous Due Diligence

We work closely with each developer that approaches us for a property-project loan to fully understand the corporate structure of the borrower and to obtain information of their identity through a process of Know Your Client (KYC) checks. We also establish their integrity through Anti Money Laundering (AML) searches.

We scrutinise the viability of their proposition from every perspective: We evaluate whether each borrower’s loan-repayment schedule is realistic and their exit strategy (sale of the developed property or refinance), to ensure the most profitable and secure route of action is followed. We employ lawyers for every loan that we provide, who work with the borrower’s legal adviser.

Loan calculation

We use several metrics to determine how much a borrower can receive through our platform. Firstly, we run through the borrower's financial plan, examining the projected costs of a project, how long it will take them to build out and the run off time to redeem the loan in full. We seek 3rd party advice from Registered RICS valuers who provide us with full report on market dynamics, the purchase price, the out turn value when the works have been completed, view on developers build costs and appraisal. From this we understand the estimated profit the developer will make. See here how we calculate Loan to Value or Loan to Cost on projects.

2nd Legal Charge

We take out 2nd legal charge on all the properties we list for investment so that, in the unlikely event that the borrower defaults on their repayments, we can take charge of the project and recover investors’ money. Unlike many other marketplace property lending companies, we have in-house, hands-on property expertise to enable us to do this. We would look at each case on its own merits; how advanced the project is, how much money is left in the project account; market conditions, etc. We are able to dictate the way forward to ensure any losses and delays are mitigated, this means that we do not have to sell immediately, but we hold the option to manage all aspects of the project ourselves until completion, with the aim of returning all capital and interest.

Any surplus to the initial loan amount recovered from the sale of property at the completion of a project would be used to service the forecast interest payments for the lenders. In such events, CrowdProperty will write to the lenders through the platform and via email as appropriate.

Extensions

If a borrower needs an extension or further advances on the loan, we carefully assess the issues before agreeing to an extension. This is sometimes necessary due to factors beyond their control – for instance delays with planning permission or hold-ups with the final sale of the finished property. Generally, in the event that a project overruns, the borrower will pay a higher interest rate from the original due date up until the loan is settled. The additional interest will be paid along with the original capital and pre-agreed interest at the completion of the extended loan.

We monitor the progress of the project constantly, until its successful completion and the loan is repaid. We employ Independent Monitoring Surveyors who will undertake an Initial inspection and report on the planning, technical and procurement of the works together with suitability of the borrower to deliver. This report is delivered before we write the loan. During the loan period if the borrower requires a drawdown from the Facility the IMS will inspect the works and report on progress and recommend the amount that can be submitted to the borrower. This process adds strength to our processes as there are 3rd party professional inspections and from this the IMS can make us aware if the build out is experiencing any problems.

Although our robust due diligence does not completely remove the risk inherent in property investment, our track record indicates that it has a major impact on securing investors’ funds.

DEFAULTED LOANS

Given the higher level of Risk involved in the 2nd charge loans written there is clearly a higher level of risk in these loans defaulting. CrowdProperty has a process of recovery that involves the engagement of LPA Receivers and this 3rd Party would take over the loan and work towards its recovery. LPA Receivers would be paid out ahead of any capital receipts so creating further risk on the 2nd charge loan.

OPERATOR INSOLVENCY

Marketplace platforms are not covered by the FSCS. In principle, if a platform were to fail, or become insolvent, their investors could lose all of the money they have pledged.

However, lending companies which are regulated by the Financial Conduct Authority, like CrowdProperty, are required to protect investors’ money in several ways if the platform were to fail:

You authorise us to instruct the ISA Manager and/or the Payments Provider to transfer any money it holds for you in the Platform Accounts to a replacement services provider without seeking your express instruction to do so, provided the new services provider has the appropriate regulatory permissions.

No interest is payable on money held in your Platform Accounts and no fees are charged to you in respect of establishing the accounts.

By accepting the terms of this Agreement, you appoint the ISA Manager to hold any monies paid into your IFISA Account, including funds deposited by you to fund loans and money paid to you by the borrower.

The ISA Manager will treat you as its client and will treat money in your IFISA Account as “Client Money” held in an approved bank account in accordance with the FCA's client money rules. The ISA Manager will use reasonable skill and care for the selection, use and monitoring of any approved bank with which Client Money is held, but will not be liable for their acts or their insolvency.

The Client Money will be held in a pooled account and will not be separately identifiable from Client Money of other clients of the ISA Manager or its associates on the relevant bank’s books and records. Accordingly, should the ISA Manager default on its obligations to its clients, any shortfall in Client Money held by the relevant bank may be shared pro-rata among all clients whose money is held in the pooled client money account.

If a bank with which the ISA Manager holds Client Money fails (including the appointment of a liquidator, receiver, administrator, or trustee in bankruptcy, or any equivalent), this will constitute a secondary pooling event under the FCA Rules, which may result in a shortfall in the funds held for you.

In the event of our insolvency, the ISA Manager will continue to hold your money, but will not facilitate the funding of any new loans. The ISA Manager will notify you of any changes to how your account will be managed in such an event.

In the event of the ISA Manager’s insolvency, we will attempt to find an alternative services provider to enable the CrowdProperty Service to continue to function.

As an FCA regulated lender we have a back-up servicing arrangement in place. This means that in the unlikely event that CrowdProperty ceases to trade, the back-up service provider would take our place in operationally managing and administering existing loan contracts between investors and borrowers. It would continue to receive loan repayments from borrowers, and to process and distribute these payments to investors. In practice, this means that if our platform does fail, all of investors’ existing loans would be unaffected.

The 2nd legal charge that we take out on all property projects on your behalf, would still stand, if CrowdProperty became insolvent. This would continue to safeguard investors’ money, so that if the project developer was to default on repayments, the back-up service provider would operate on investors’ behalf and take over the project to extract and pay back investors’ funds in the best way possible.

Our current back-up service provider is also authorised by HMRC as an ISA Manager and would be able to take over the administration of CrowdProperty IFISA accounts. This means loans held within a CrowdProperty IFISA would keep their tax-free benefits.

All FCA regulated marketplace lending platforms are required to hold capital reserves (extra cash) to help mitigate any business and financial risks. This is something we have always done.

Although we monitor the loans closely, this does not mean your returns are guaranteed. You may lose all of what you invest, and past performance is not an indication of future results.

ILLIQUIDITY

Any investment you make through the platform will be highly illiquid – you will not be able to withdraw your money before the end of the investment term and only once the project has successfully exited and paid back. This is because there is no active secondary market for loans to investee property development companies. The only way you can release your money is at the end of the investment term when the property is sold or refinanced, with a different loan being concluded.

TAX

You will be responsible for the payment of your own tax, which, as a borrower selling a property project, may include capital gains tax, and, as an investor the interest you receive may be liable to income tax. Individual circumstances will be different, and we do not provide tax advice and you should seek independent tax advice before investing if you are unsure of your position. It is still your responsibility to ensure that your tax return is correct and is filed by the deadline and any tax owned is paid on time. If you are unsure how this investment will affect your tax status you must seek professional advice before you invest.

CrowdProperty is an approved Innovative Finance ISA provider by HMRC.

PERFORMANCE INDICATORS

Past performance is no indicator of future performance, and we make all our judgements on a project-by-project basis. The internal calculations and opinions of CrowdProperty are subject to change at any time.

INSURANCE

We have comprehensive insurance policies in place that are tailored to our business, these cover fraud and crime, terrorism, and contingent buildings insurance for our loans. Should a loss be suffered on a loan as a result of fraud or crime we will, where possible, seek to claim on the insurance policies in an effort to return any shortfall to investors.

INVESTMENT ADVICE

CrowdProperty do not offer any advice to lenders or borrowers. We recommend that if you are not sure about anything you should seek independent third-party advice. We recommend that you do your own due diligence on any project before you decide if you want to invest. CP Capital projects are high risk and therefore only available to High Net Worth and Sophisticated Investors.

TECH SECURITY

Central to our business model at CrowdProperty (including the CP Capital website) is our technology platform, which is designed and supported in-house by our technical experts. This provides us with the flexibility and nimbleness to continually improve the services for both Lenders and Borrowers. We have integration into Goji and Modulr to give our customers the best experience possible.