CrowdProperty Experience

£907m

Property funded

£522m

Facilities agreed

3,854

Homes funded

£450m

Lent

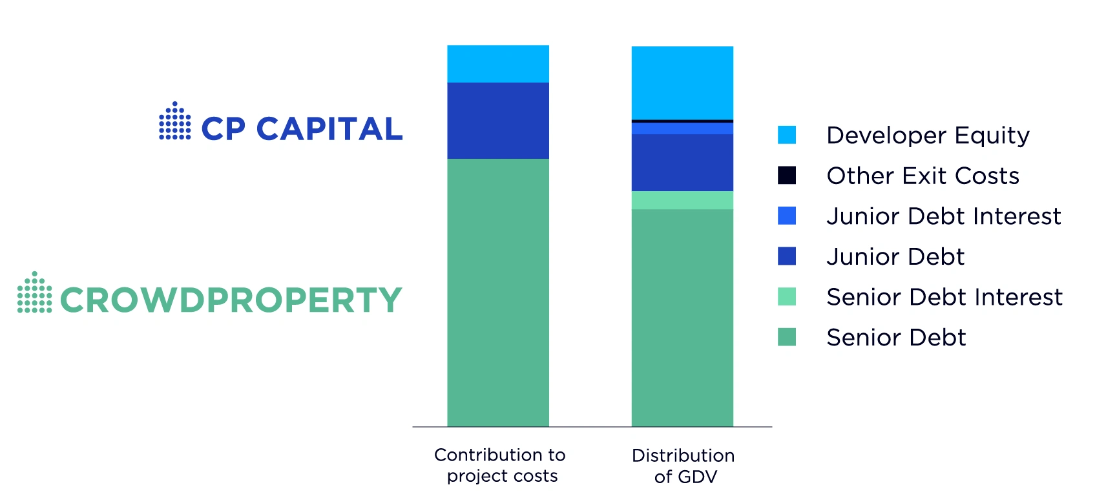

What is CP Capital mezzanine finance?

Mezzanine finance from CP Capital tops up your senior development finance to complete your project funding needs. Senior debt typically accounts for 70-85% of costs; mezzanine finance from CP Capital can top this up to finance up to 95% of costs.

| Detailed statistics by year | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|

Total | |

| Total Originated | 5,182,000 | 2,290,000 | 4,407,000 | 24,607,500 | 38,142,000 | 88,158,849 | 70,294,574 | 126,893,173 | 119,863,680 | 31,230,550 | 11,187,025 | 522,256,351 | |

| Total Lent | 4,026,000 | 2,288,000 | 4,403,000 | 15,192,759 | 28,942,568 | 71,095,477 | 52,907,473 | 94,652,294 | 105,446,474 | 51,110,345 | 19,731,641 | 449,796,032 | |

| Number of Loans | 12 | 7 | 8 | 32 | 81 | 154 | 127 | 191 | 244 | 145 | 87 | 1,088 | |

| Total GDV Funded | 11,713,500 | 4,486,000 | 8,852,000 | 45,478,000 | 64,711,590 | 174,042,730 | 108,967,785 | 229,455,493 | 188,948,478 | 52,107,700 | 18,019,000 | 906,782,276 | |

| Total Units Funded | 71 | 30 | 69 | 287 | 363 | 741 | 561 | 754 | 708 | 209 | 61 | 3,854 | |

| Total Capital Paid Back | 4,026,000 | 2,287,500 | 4,403,000 | 14,855,530 | 27,247,720 | 56,912,432 | 46,398,512 | 64,633,306 | 55,900,983 | 7,433,244 | 160,000 | 284,258,227 | |

| Total Interest Paid Back | 404,763 | 243,719 | 449,589 | 1,790,333 | 2,635,678 | 5,147,566 | 3,547,683 | 6,363,056 | 7,929,090 | 3,193,858 | 327,060 | 32,032,395 | |

| Total Paid Back | 4,430,763 | 2,531,219 | 4,852,589 | 16,645,863 | 29,883,398 | 62,059,998 | 49,946,195 | 70,996,362 | 63,830,074 | 10,627,102 | 487,060 | 316,290,622 | |

| Total Borrower ContractRate7 | 10% | 12% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 11% | 12% | 10% | |

| Total Borrower Actual Rate8 | 10% | 16% | 10% | 10% | 10% | 10% | 10% | 6% | 11% | 12% | 12% | 10% | |

| Total Lender Actual Rate8 | 8% | 13% | 8% | 8% | 8% | 7% | 8% | 3% | 9% | 11% | 9% | 7% | |

| Total Projects (180 Days Late) 4 | 2 | 0 | 0 | 3 | 9 | 26 | 12 | 31 | 22 | 3 | 0 | 108 | |

| Total Projects (180 Days Late) Repaid | 2 | 0 | 0 | 2 | 8 | 17 | 6 | 14 | 3 | 0 | 0 | 52 | |

| Total Actual Losses Percentage | 0% | 0% | 0% | 0% | 0% | 2% | 1% | 4% | 0% | 0% | 0% | 1 | |

| Total Anticipated Losses Percentage | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | |

| Total Actual Capital Losses | 0 | 0 | 0 | 0 | 40,043 | 1,464,462 | 565,148 | 3,391,237 | 219,464 | 0 | 0 | 5,680,354 | |

- Loan to current market value is the average of the first release of capital to the borrower divided by the Current Market Value of the property being offered as security.

- Loan to GDV Excluding Interest is the planned total capital facility divided by the RICS assessed Gross Development Value (GDV) averaged over all projects.

- Loan to GDV Including Interest is the planned total capital facility plus interest divided by the RICS assessed Gross Development Value (GDV) averaged over all projects.

- Total Projects > 180 Days Late As per the FCA definition for property loans, technical default of a project is 180 days which must be disclosed. CrowdProperty has recovered all > 180 days late projects fully in terms of both capital and interest.

- Actual Defaults this is the actual loss of capital invested, if any, on a loan in Default, after any money we've been able to get back from the borrower. We take the Second Legal Charge on all loans as security.

- Anticipated Defaults are 4% of capital invested due to retaining Second Charge security on all projects we fund through the CP Capital platform. The Second Legal Charge is the second highest level of security with the holder being paid after the First Legal Charge holder.

- Contracted Rates for Borrower and Investors are the averages across all loan agreements.

- Actual Rates show the real returns for Investors and the actual paid by Borrowers. This is based on the actual interest paid for all projects. Some actual rates will be higher than contract for Investors as some loans run late and will be subject to a higher rate.

- Only rates for paid back projects are included

- All reporting is based on the year of origination.

- For all averages, subsequent raises are not included in the averages to ensure no double counting.

- RICS – Royal Institution of Chartered Surveyors

This material contains statistics that have been prepared by the CrowdProperty Group. The underlying data is based on past projects, however this information should not be construed as legal, tax, investment, financial, or accounting advice. Any future forecasts that are shown combine our knowledge, with a number of risks, uncertainties and assumptions about any future states, many of these are beyond the control of CrowdProperty. Nothing contained within the information provided is or should be relied upon as a warranty, promise, or representation, express or implied, as to the future performance of any loan through CrowdProperty. Any historical information contained in this statistical information is not indicative of future performance.

Resilience Statement Abstract

As part of our dedication to maintaining our unparalleled standard of due diligence through more than 5 years of lending, CrowdProperty has undertaken a thorough, multi-scenario loan book resilience study on all active loans to understand the loan book’s exposure to economic volatility. CrowdProperty analysed the causes of the 2007/08 and 1989/90 crises and from the aggregation of localised house price data during the 2007/08 and 1989/90 crises, derived resilience resource scenarios. The scenarios, analysed and applied at localised levels given differing impacts, have been examined to resource the resilience of the existing loan book to determine what economic conditions would compromise the security underpinning CrowdProperty loans, potentially compromising the 100% capital and interest payback track record of the platform to date. From this resilience resourcing, validation of our entry criteria for loans is detailed in this report and the resultant data analytics built into future loan appraisal assessment.

Resilience Statement Disclaimer

Resilience testing is not investment advice. Our resilience testing is an evaluation of our current loan book, based upon previous economic crises which impacted the residential property (housing) market. The main purpose of our testing is to evaluate our current loan criteria and processes, as well as to assess the potential impact of another housing market downturn. Although our resilience testing shows our loan book should be secure in the event of another economic crisis, past performance is not a guide to future returns and, when lending towards any investment product, your capital is at risk.